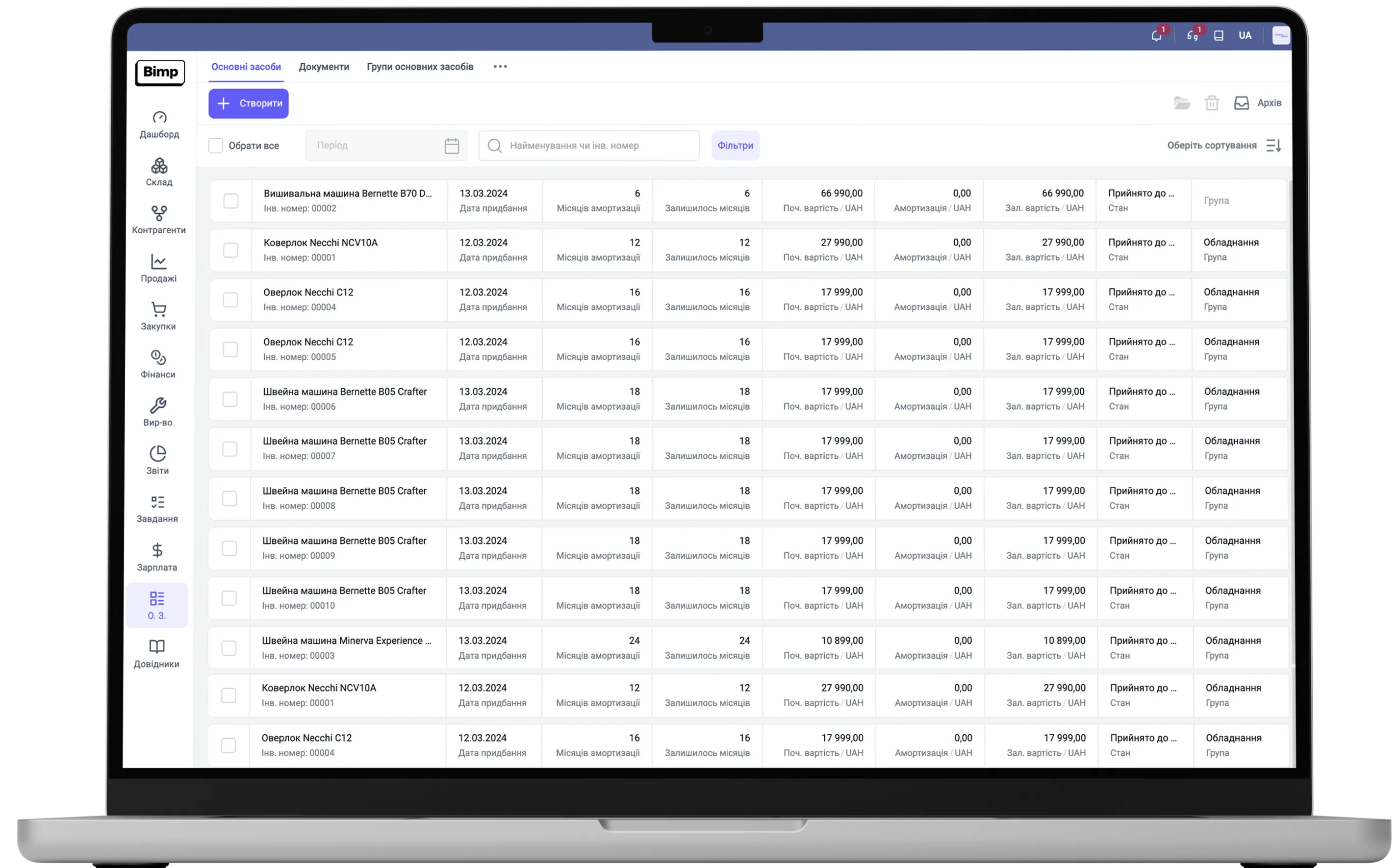

Bimp ERP system for equipment accounting: overview of the "Fixed assets" module

Bimp ERP system for equipment accounting: overview of the "Fixed assets" module

The Bimp ERP system allows automated equipment accounting for production. The solution from Bimp is easy to implement and suitable for any product business, except offline retail.

Functions of the "Fixed assets" module:

- accounting of production equipment and office equipment;

- accounting of depreciation of fixed assets;

- grouping of equipment;

- tracking inventory and equipment movement;

- generating reports on depreciation and equipment condition;

- inventory and control of changes in the fixed assets register.

Who the Bimp fixed assets management system is suitable for:

The ERP system is easy to implement and suitable for any product business except offline retail.

For distributors

For manufacturers

For online stores

For importers

For warehouse business

For logistics companies

The "Fixed assets" module will be useful for:

- warehouse managers;

- accountants;

- directors;

- enterprise managers;

- analysts.

What tasks does the Bimp fixed assets accounting system solve?

- Lack of centralized accounting for working equipment. The Bimp accounting system stores all information about equipment, its condition, location, maintenance history, and responsible persons.

- Incorrect accounting of changes in the condition of fixed assets. The ERP system sends notifications about repairs, write-offs, or equipment transfers, all changes are recorded instantly.

- Lack of control over equipment transportation and responsible persons. Bimp provides a mechanism to track equipment movement between departments and assign responsible persons for each piece of equipment.

Thanks to optimizing these processes, enterprises can significantly improve accounting accuracy and avoid errors.

Setup of the "Fixed assets" module

- Accounting of receipts. Implement detailed accounting of new equipment in a unified system and store all information about the supplier, responsible person, equipment cost, and commissioning date.

- Depreciation reports. Generate equipment depreciation reports containing detailed information about the amount of accrued depreciation, residual equipment value, financial expenses, and change dynamics.

- Group depreciation. Allows you to reduce the time for accounting and minimize errors. The system lets you set depreciation parameters according to accounting requirements.

Advantages of using the "Fixed Assets" module

The Bimp system enables enterprises to maintain equipment records, improve the transparency of financial reporting, and monitor the condition of working equipment.

- Automatically generate detailed reports on equipment condition, accrued depreciation, and financial expenses in a convenient format.

- Receive accurate financial forecasts on depreciation and equipment renewal costs, helping you plan your budget effectively.

- Flexibly configure depreciation parameters in accordance with your company’s accounting policy and legal requirements.

Forget about chaos in record keeping, because the ERP system Bimp is your reliable assistant for accounting and controlling production equipment. Manage all processes in a single system: acquisition of new equipment, transportation, repair, and order control.

Free access to the Bimp ERP system

Try free access to the system for 14 days — all features will be fully available. Take advantage of this opportunity and explore the service. If you have any questions, you can always contact our support team.

Submit a request on the website right now and get a free consultation from our experts with a demonstration of the ERP system’s functionality. They will help you implement automated inventory management quickly and without unnecessary costs. Bimp is always happy to support your business!